I have dabbled in robo-advisor a few years back. The March 2020 brief crash provided me an opportunity to put a lump sum of money into StashAway (SA) and it was a happy pill for me as I saw my investment grew almost exponentially like how the FED threw in liquid gold into stock market. Nonetheless, the bull run did have to come to an end. Sooooo, practising a lot of financial guru’s mantra of not putting my eggs in one basket, the depreciating MYR sent me to look out for other investment vehicles, perhaps, in a different currency.

Reasons I chose Syfe in February 2022:

- SGD has always proven its worth….it has stood and always stands strong in tough times. Mr. Market has always been fickle and emotional and I supposed taking a bite in this resilient currency would yield something in the future. An economics lesson >10 years ago in junior college reminded me that Singapore is an importing country due to its lack of natural resource, they will only appreciate their currency in order to maintain its purchasing power (Do correct me if I were wrong). Their track record is impeccable if we consider how 1 SGD : 1 MYR has become 1 SGD : 3.29 MYR as of today.

- It is regulated by the Monetary Authority of Singapore and that’s gold standard i supposed. The monies held in our investment portfolios are also held in a separate custodian account via Saxo Capital Markets. Supposedly a Lehman Brother’s bank run occurs (again) and Syfe or Saxo goes bust, our monies remain safe.

Why Syfe REIT + out of other portfolios offered by them?

There are many reasons people choose to invest. To strike their 1m through scalping or FOREX. To be the next Michael Burry beating (and having the nerve to go against) the market. There are just so many investment vehicles/derivatives/swaps/options which is so dang confusing. I kinda started investing in 2017 and the bull run kept me going. I was thrilled to be making a fair bit of money out of my rather above average salary as a resident in Aussie. My inflated ego and rather elementary trading knowledge rendered me making choices that I regret till today (As I am still facing almost 50% paper loss in the few trading accounts I owned). As Warren Buffett once said ” You never know who’s swimming naked until the tide goes out”, I consider myself a full time health care worker (HCW) and neither have the time OR flair to beat the big investment brothers. So I decided to play safe and chose something which suited me most –relatively stable, rates higher than inflation, little time to monitor, trustworthy where i plan to dollar cost average over the next 30 years until retirement.

So I will attempt to break down Syfe reit + into laymen terms by referencing to their website and my pathetic informal knowledge of econs/personal finance.

How does Syfe Reit+ work?

Syfe Reit+ tracks the SGX’s iEdge S-REIT Leaders Index by investing in 20 largest Singapore REITs.

REITs = Real Estate Investment Trust. A simple explanation by Investopedia defines REIT as a company that owns, operates or finances income-producing properties. Very often, REITs offer little in the way of capital appreciation but provides a steady stream of income for investors. Something like you own a piece of Vivocity but instead of having to hassle your tenants to pay their rent, there is a management team handling that.

The Malaysians are most likely more familiar to malls like MidValley, Gardens, Sunway Pyramid etc which are managed by popular REITs manager including SUNREIT / IGB REIT. There are obviously other REIT categories besides retail –> hospitality, office which we can easily purchase in Bursa Malaysia. But for an overseas investor like me who has minimal bullets, I find it taxing to purchase a big sum of S-REITs (after taking into account stamp duty and brokerage).

Looking at my 100% REIT+ portfolio, I own a wide array of REITs including Mapletree Pan Asian Commercial Trust (MPACT), CapLand Ascendas REIT (CAREIT), Mapletree Logistics Trust (MLT), CapitaLand Integrated Commercial Trust (CICT), Keppel REIT (KREIT), Suntec Real Estate Investment Trust (SUN), Frasers Logistics & Industrial Trust (FLT), Keppel DC REIT (KDCREIT), Mapletree Industrial Trust (MINT), Parkway Life Real Estate Investment Trust etc. (My hands are getting tired now and I shall stop listing all REITs).

Some people who like to play (even) safer can also have the option to choose Syfe REIT with risk management. This means they will combine both REIT + Singapore Government Bond in your portfolio. Your money is invested via the ABF Singapore Bond Index Fund which provides lower dividend yield but less fluctuation in terms of prices.

Returns

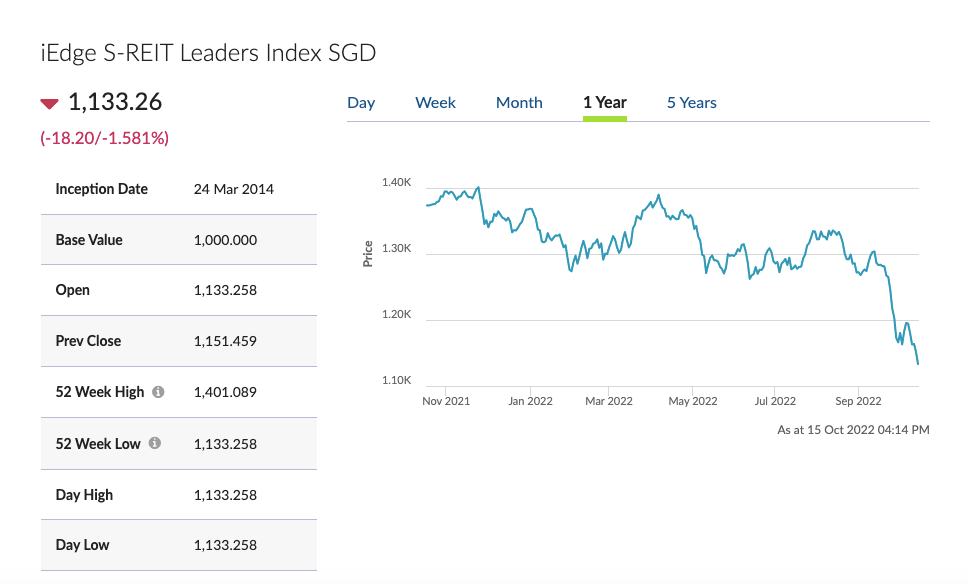

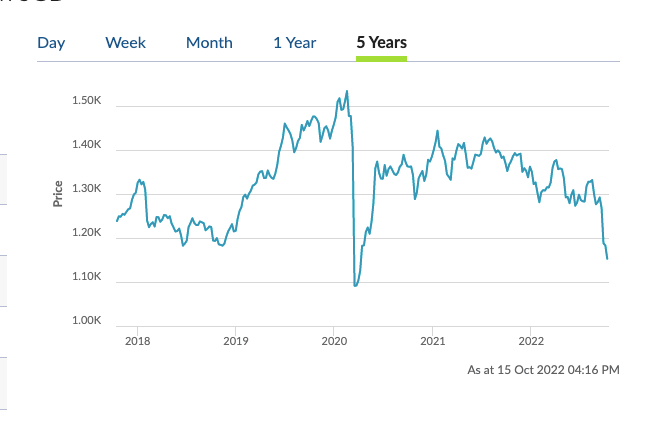

One look at returns so far in 2022 has been nothing but depressing/disappointing/abysmal. The first screenshot was directly taken from Syfe website. And the second screenshot was from i-edge website (1- year return). Any person who can read a simple graph can tell that in correlation with our depressing economy worldwide, REITs have also not been spared in this blood bath. If it makes you feel any better, the SPDR S&P 500 ETF has registered a -19.83% 1-year return while the SPDR Dow Jones Industrial Average ETF trust has lodged a -15.91% 1- year return so far.

And as we zoom the graph out to 5 years, the iEdge S-Reit Leaders Index is almost going to hit its historical rock bottom in year 2020 during Covid-19 pandemic times (which was unexpectedly staged with a rebound).

My portfolio returns so far in a screenshot. (Invested since February 2022)

My Time weighted returns is a (MEH) -11.34% so far.

What is time weighted return (TWR)?

Quoting Investopedia again,

It is difficult (and unfair) to determine the amount of money earned on a portfolio when we make multiple deposits and withdrawals over time. One might simply take the ending balance and subtract the beginning balance to calculate the rate of return. But this does not take into account the deposits or withdrawals made over the time invested. To put it simply, deposits and withdrawals distort the value of the return on our portfolio.

The time-weighted return basically breaks up the return on an investment portfolio into separate intervals based on whether money was added or withdrawn from the fund.

Feel free to read this piece on TWR on Investopedia with scenarios (oooh how med students and exam goers love their scenario-based questions)

https://www.investopedia.com/terms/t/time-weightedror.asp

In conclusion, am I now crying under the blanket lamenting on the misery of losing -11.34% on my Syfe REIT+ portfolio? Nah market goes up and down. Like the choices we make in our lives, we have to take responsibility (and hopefully hold onto) of our investment principles and decisions. I might be unlucky experiencing the market downturn where every major indices have been hit hard by inflation/FED interest rate spike/Russia-Ukraine war, but I do believe in the strong SGD (MAS tightening their monetary policy few days ago to combat inflation) and the immense human resources led by some smarty pants. Their brains and foresightedness will only draw more FDI hence increasing S-REITS portfolio value in the next century.